Dubai: The New Hub for Family Offices, Hedge Funds, and Private Banking Institutions

Dubai has swiftly emerged as a prime destination for family offices, hedge funds, and private banking institutions, drawing attention from global decision-makers. With its strategic location, robust regulatory framework, and business-friendly environment, the emirate offers significant advantages for those in the financial industry looking for growth, stability, and a gateway to emerging markets.

Family Offices:

Dubai has long been home to a growing number of ultra-high-net-worth individuals (UHNWIs) and family-owned businesses. The city’s forward-thinking approach has led to the creation of dedicated legal frameworks, such as the Dubai International Financial Centre (DIFC), specifically designed to accommodate Single Family Offices (SFOs). This framework provides a structured environment for wealth preservation, succession planning, and tax-efficient strategies, making Dubai an ideal hub for family-run institutions managing generational wealth.

As UHNWIs seek secure jurisdictions that allow them to manage and grow their assets while enjoying tax benefits, Dubai continues to stand out as a destination of choice.

Hedge Funds:

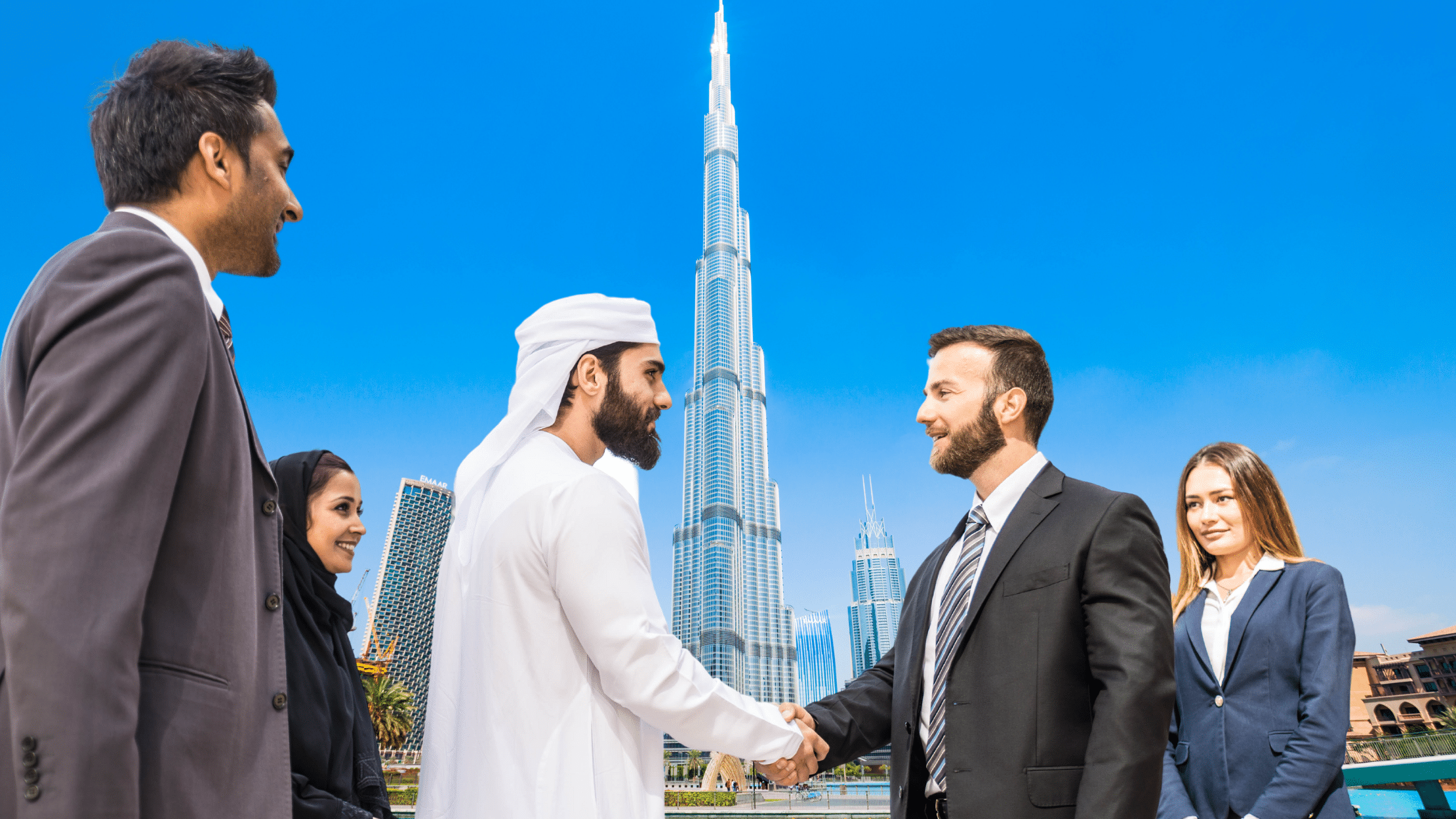

Hedge funds, often in search of growth opportunities in emerging markets, are increasingly flocking to Dubai. The DIFChas become a pivotal player, hosting over 1,000 hedge fund employees as of 2024, with prominent firms like Millennium Management and Balyasny Asset Management establishing operations. Dubai’s appeal lies in its seamless access to markets across the Middle East, Asia, and Africa, allowing hedge funds to capitalize on new opportunities in these fast-growing regions.

In addition, the city’s sophisticated legal framework, combined with its access to talent, offers hedge funds a competitive edge. As a result, Dubai has become one of the few financial centers in the world where hedge funds can scale their operations quickly.

Private Banking Institutions:

Private banking is another area witnessing exponential growth in Dubai. Banks like JPMorgan and Investec have established or expanded their private banking teams in the region to cater to the increasing demand for wealth management services. With Dubai’s large base of UHNWIs, affluent families, and institutional investors, these banks are strategically positioning themselves to tap into the rising wealth of the Gulf region.

Private banks in Dubai provide a broad range of services tailored to local and international clients, focusing on personal wealth management, estate planning, and investment solutions that meet the unique needs of their high-net-worth clientele.

Why Dubai?

- Strategic Location: Dubai serves as an ideal hub connecting Western Europe to the Middle East, Africa, and Asia, providing family offices, hedge funds, and private banks with access to a broad range of clients and markets. This geographical advantage gives firms the ability to manage global portfolios from a central, business-friendly location.

- Robust Regulatory Framework: The DIFC has built a reputation as a leading financial center with a comprehensive regulatory system aligned with international standards. It offers businesses a well-structured environment, including an independent judicial system based on common law. The ease of business setup and operations, along with strong regulatory oversight, offers assurance to international firms.

- Business-Friendly Policies: Dubai has long been known for its pro-business government policies, which include zero personal and capital gains taxes, 100% foreign ownership, and tax exemptions in the DIFC. This makes it a highly attractive option for firms seeking to maximize profitability and reduce regulatory friction.

- Talent and Innovation: Dubai’s focus on fostering innovation through initiatives like Dubai Future Foundationand Expo 2020 ensures a steady flow of talent and ideas. It is positioning itself as not just a financial hub but also a center for technological advancements, offering financial institutions an environment conducive to growth.

The combination of Dubai’s strategic positioning, sophisticated financial infrastructure, and attractive tax policies make it a natural choice for family offices, hedge funds, and private banking institutions looking to expand into new territories. The city offers an unparalleled opportunity to tap into both emerging and established markets while benefiting from a secure and business-friendly environment.

As decision-makers look for stable yet growth-oriented hubs, Dubai stands out as a top contender. With growing global investment in the region and continuous improvements in infrastructure, the UAE is well on its way to solidifying its status as a global financial powerhouse.

By considering Dubai, executives in these industries can strategically position their firms for future growth and capitalize on the opportunities offered by one of the most dynamic financial centers in the world.